It this the change you were hoping for?

Once again, from The Economist.

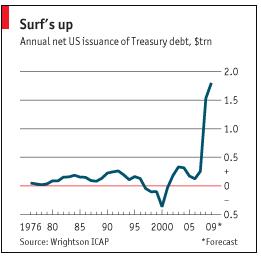

Wrightson ICAP, a research firm, predicts the Treasury will issue $1.8 trillion this year, which combined with $1.5 trillion last year, would exceed all the net borrowing of the prior 27 years combined (see chart).Do you really see a Democrat Congress and a Democrat President cutting the deficit down the road any time soon?

Meanwhile, the Treasury is facing growing competition for funds in the corporate-bond market, which has seen some unusual levels of activity since the start of the year. Excluding debt backed by the government, the total reached $76 billion, not far short of the previous record for a January, $82 billion in 2001.

The revival of corporate-bond markets, if sustained, would be good news. Moreover, there is still sturdy demand for Treasuries from abroad; foreigners refused to dump them even when they lost confidence in mortgage-backed debt last year. But America cannot take things for granted. If private credit continues to revive and there is no sign budget deficits are coming down, investors may worry that America will attempt to inflate its debts away. Then the storm really will hit Treasuries.

Remember, you're not being paranoid if people are actually trying to get you.

No comments:

Post a Comment