I listen.

Here we stand more than a year into a grave economic crisis with a projected budget deficit of 13% of GDP. That's more than twice the size of the next largest deficit since World War II. And this projected deficit is the culmination of a year when the federal government, at taxpayers' expense, acquired enormous stakes in the banking, auto, mortgage, health-care and insurance industries.If you are scratching your head, read it all.

With the crisis, the ill-conceived government reactions, and the ensuing economic downturn, the unfunded liabilities of federal programs -- such as Social Security, civil-service and military pensions, the Pension Benefit Guarantee Corporation, Medicare and Medicaid -- are over the $100 trillion mark. With U.S. GDP and federal tax receipts at about $14 trillion and $2.4 trillion respectively, such a debt all but guarantees higher interest rates, massive tax increases, and partial default on government promises.

But as bad as the fiscal picture is, panic-driven monetary policies portend to have even more dire consequences. We can expect rapidly rising prices and much, much higher interest rates over the next four or five years, and a concomitant deleterious impact on output and employment not unlike the late 1970s.

...

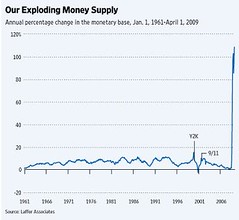

The percentage increase in the monetary base is the largest increase in the past 50 years by a factor of 10 (see chart nearby). It is so far outside the realm of our prior experiential base that historical comparisons are rendered difficult if not meaningless. The currency-in-circulation component of the monetary base -- which prior to the expansion had comprised 95% of the monetary base -- has risen by a little less than 10%, while bank reserves have increased almost 20-fold. Now the currency-in-circulation component of the monetary base is a smidgen less than 50% of the monetary base. Yikes!

...

It's difficult to estimate the magnitude of the inflationary and interest-rate consequences of the Fed's actions because, frankly, we haven't ever seen anything like this in the U.S. To date what's happened is potentially far more inflationary than were the monetary policies of the 1970s, when the prime interest rate peaked at 21.5% and inflation peaked in the low double digits. Gold prices went from $35 per ounce to $850 per ounce, and the dollar collapsed on the foreign exchanges. It wasn't a pretty picture.

Now the Fed can, and I believe should, do what it must to mitigate the inevitable consequences of its unwarranted increase in the monetary base. It should contract the monetary base back to where it otherwise would have been, plus a slight increase geared toward economic expansion. Absent this major contraction in the monetary base, the Fed should increase reserve requirements on member banks to absorb the excess reserves. Given that banks are now paid interest on their reserves and short-term rates are very low, raising reserve requirements should not exact too much of a penalty on the banking system, and the long-term gains of the lessened inflation would many times over warrant whatever short-term costs there might be.

Alas, I doubt very much that the Fed will do what is necessary to guard against future inflation and higher interest rates. If the Fed were to reduce the monetary base by $1 trillion, it would need to sell a net $1 trillion in bonds. This would put the Fed in direct competition with Treasury's planned issuance of about $2 trillion worth of bonds over the coming 12 months. Failed auctions would become the norm and bond prices would tumble, reflecting a massive oversupply of government bonds.

In addition, a rapid contraction of the monetary base as I propose would cause a contraction in bank lending, or at best limited expansion. This is exactly what happened in 2000 and 2001 when the Fed contracted the monetary base the last time. The economy quickly dipped into recession. While the short-term pain of a deepened recession is quite sharp, the long-term consequences of double-digit inflation are devastating. For Fed Chairman Ben Bernanke it's a Hobson's choice. For me the issue is how to protect assets for my grandchildren.

No comments:

Post a Comment