Events in the Second Russo-Ukrainian War (or whatever it is being called, this is what I call it with the 1st being in 2014), are moving fast. It seems anything you write will be OBE in a few hours, but write one must.

Case in point; going in to the weekend Germany was stuck in, "We are pausing NS2..." and we find our way to Monday where she is giving the nod for artillery, fighter jets, anti-aircraft, and anti-armor weapons to Ukraine as fast as they can get there and announcing an unprecedented increase in defense spending.

So, today let's focus on something that isn't quite as sexy as air superiority or logistics convoys, but may be the most important news of the day; financial sanctions.

Let's go back to Chris Morris at the BBC five days ago;

Notably only about 16% of Russia's foreign exchange is now actually held in dollars, down from 40% five years ago. About 13% is now held in Chinese renminbi.

All of this is designed to protect Russia as much as possible from American-led sanctions.

Over time it has reduced its reliance on foreign loans and investments, and has been actively seeking new trade opportunities away from Western markets.

China is a big part of that strategy.

The government in Moscow has also taken initial steps to create its own system of international payments, in case it gets cut off from Swift - a global financial messaging service which is overseen by the major Western central banks.

And it has been cutting the size of its budget - prioritising stability over growth.

That has meant the Russian economy has grown at an average of less than 1% a year over the past decade. But it may have become more self-reliant in the process.

...

There's no question that sanctions can have an impact, but a package as broad as this has never been imposed on an economy as large as Russia.

And to make it effective, the West would have to be in it for the long haul.

This was all theory last week, now we come to a very different reality this last day of February...and Russia gets a vote. We can't assume she won't react.

Also from the BBC, as of this AM US Eastern time;

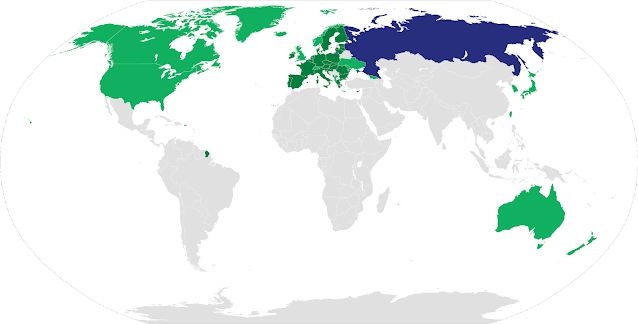

Western nations are imposing increasingly severe sanctions on Russia following its invasion of Ukraine.

The measures are designed to cripple Russia's economy and punish its government for taking military action.

As you read the above and what is to follow, there is a word as old as war that should come to mind; blockade.

There are benchmarks about how nations can interpret blockades, and this is but one example in living memory;

A casus belli played a prominent role during the Six-Day War of 1967. The Israeli government had a short list of casūs bellorum, acts that it would consider provocations justifying armed retaliation. The most important was a blockade of the Straits of Tiran leading into Eilat, Israel's only port to the Red Sea, through which Israel received much of its oil. After several border incidents between Israel and Egypt's allies Syria and Jordan, Egypt expelled UNEF peacekeepers from the Sinai Peninsula, established a military presence at Sharm el-Sheikh, and announced a blockade of the straits, prompting Israel to cite its casus belli in opening hostilities against Egypt.

We can't forget this from the edge of living memory either;

In 1939 the United States terminated the 1911 commercial treaty with Japan. “On July 2, 1940, Roosevelt signed the Export Control Act, authorizing the President to license or prohibit the export of essential defense materials.” Under this authority, “[o]n July 31, exports of aviation motor fuels and lubricants and No. 1 heavy melting iron and steel scrap were restricted.” Next, in a move aimed at Japan, Roosevelt slapped an embargo, effective October 16, “on all exports of scrap iron and steel to destinations other than Britain and the nations of the Western Hemisphere.” Finally, on July 26, 1941, Roosevelt “froze Japanese assets in the United States, thus bringing commercial relations between the nations to an effective end. One week later Roosevelt embargoed the export of such grades of oil as still were in commercial flow to Japan.” The British and the Dutch followed suit, embargoing exports to Japan from their colonies in southeast Asia.

In today's global financial system that unlike the last world war where nations held physical assets like gold that could be loaded on cruisers as payment, much of nations' "wealth" is stuck in the cyber-world's 1s and 0s.

They are among the toughest measures nations can use, short of going to war.

As we go down this route - even with the Swiss of all people - we need to be clear-headed about how this can be seen by the Russians.

The action is aimed at cutting Russia off from the international financial system and to "harm their ability to operate globally".

A ban from Swift will delay the payments Russia gets for exports of oil and gas.

Cutting off a nation from its access to funds not just to fight but to feed, house, and employ its people - if we now consider "cyber" to be a domain like land, sea, and air - is keeping a nation from accessing resources in the cyber domain - AKA a blockade - any different than a ground, sea, or air blockade with the same goal?

Western leaders have agreed to freeze the assets of Russia's central bank, to limit its ability to access its $630bn international dollar reserves.

...

Targeting a central bank of a G20 nation is unprecedented and designed to "push the whole of Russia in to as deep a recession as possible, with the added chaos of bank runs", says BBC economics editor Faisal Islam.

...

The UK, EU, US and other countries have announced curbs on products that can be sent to Russia. These include dual-use goods, which are items that could have both a civilian and military use, like high-tech items, chemicals or lasers.

Are Russian "elite" motivated by the same things Western "elites" are? That seems to be the bet;

The EU, UK, US and Canada have launched a transatlantic task force to identify and freeze the assets of sanctioned individuals and companies, targeting more "officials and elites close to the Russian government, as well as their families".

Maybe...but maybe not. Either way, we have to expect some blowback - directly or indirectly;

Russia supplies 26% of the EU's crude oil and 38% of its gas. Even a brief cut in gas supply would raise energy prices.

...

Russia's foreign ministry has threatened sanctions of its own against the West. This may include reducing or shutting off gas supplies to Europe.

...

Hitting the Russian banking sector is likely to damage firms which do business in Russia, or have assets in its banks, and the export ban on high-tech goods will hit many Western manufacturers.

There is an important thread from Georgetown political scientist Professor Abraham Newman that you need to read in full on the topic. Here are a few consolidated pull quotes from his thread;

In a world of interdependent fiat currencies central banks have to live in a world where they depend on foreign buys and holders of their money. What does this mean and how does it relate to the sanctions regime? As the @FT explains, much of the reserves are held in securities i.e. assets that need to be sold to be used. To do that, Russian central bank needs intermediaries to conduct the transactions. Most international banks are now a no go so hard to sell. But the other problem is that the Russian Central Bank doesnt actually sit on the money it has. The money is in accounts in other central banks/international bodies. Russia has to access these ledgers to use its funds. Western sanctions black this. Aside from their gold reserves, the Russian self-insurance strategy is comprised of made up stuff which lives in a financial imaginary. Their ability to use and access is interdependent on the West. Russia, then, is confronting the reality of what @henryfarrell and I have termed Weaponized Interdependence. And the consequences for the Russian economy are going to be quite severe.

As I've stated before, I cannot think like a Russian - much less Putin - so I won't even try, but I can look at their capabilities, history, and what they could do.

Let me put on my red hat.

If I were RUS COMCYBERCOM, I would have three Courses of Action of increasing severity ready to present President Putin today to take down the entire Western financial system. It would be along the historically established, "If I can't use this, then I am damn sure going to guarantee that no one else can either." You want a cyber world war? That is how you get one. Shut down the global online financial system. What do the Russians have to lose?

I hoped some smart people have wargamed this out. Again, if we are blockading, with the EU & Switzerland, Russian access to her money that they need to not just fight, but to feed and employ the people of Russia, is it beyond reason to consider that a belligerent act - especially when we are arming and giving aid to the Ukrainians? We have invaded other nations for less.

Things are moving fast - and Putin has no off ramp outside complete victory.

Good luck everyone.

No comments:

Post a Comment