China decides to play The Great Game

China has won a $3.5 billion contract to develop Afghanistan’s Aynak copper field, the largest foreign direct investment project in the history of Afghanistan.

The size of the bid -- almost double the expected amount -- surprised other potential foreign investors.

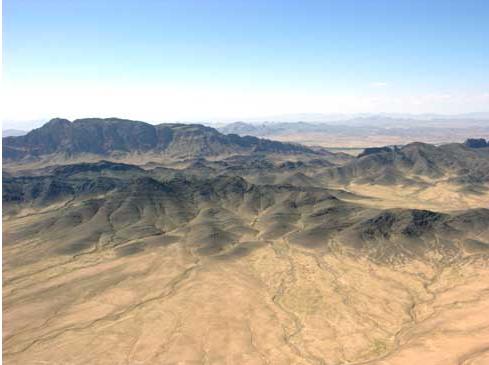

By some estimates, the 28-square-kilometer copper field in Logar Province could contain up to $88 billion worth of ore. But there is no power plant in the area that can generate enough electricity for the mining and extraction operations. And Afghanistan has never had the kind of railroad needed to haul away the tons of copper that could be extracted.

That is why a large part of the Chinese bid includes the cost of building a 400-megawatt, coal-fired power plant and a freight railroad passing from western China through Tajikistan and Afghanistan to Pakistan.

Indeed, the cost of building so much infrastructure in a volatile security environment like Afghanistan is prohibitive for many private firms. But Niklas Norling, an expert on China and Central Asia at the Stockholm-based Institute for Security and Development, says the price tag is tolerable for a Chinese state firm because the project contributes to Beijing’s plans for the development of western China and its regional trade links.

"You have to see this in the context of China’s great western development program, which has led to major investment into the western provinces [of China] and, of course, also crossborder connections to Central Asia, South Asia, and Iran," Norling says. "In order to develop the west [of China], they need energy resources, and they need other resource materials. So far, Afghanistan has remained virtually untouched by Beijing’s concerns, in contrast to China’s involvement in Central Asia, Pakistan, and Iran.

No comments:

Post a Comment